By Debbie Dry

Flexibility and efficiency makes everyone a winner.

We know from experience that most advisers shudder at the prospect of parting ways with their clients. Many of these relationships have lasted decades and they exceed more than just financial advice. Often, they are warm, personal friendships.

Over the last decade, however, more advisers have asked clients to leave their firm than ever before.

It’s a matter of capacity and client profitability. 21% of advice firm owners are seeking retirement in the next 5 years, and many of them will be looking to sell their business when the time is right. For the rest, the firms with longer term plans for scalability and growth will always be concerned about the value their clients add, and who can blame them?

With recruitment costs so high and so much competition for well qualified staff, there simply isn’t enough time in the day to look after existing clients and take on new ones. Creating capacity by leaving lower value clients behind is arguably the quickest and lowest risk solution.

Some of these low-asset, high-cost clients will have been taken onboard when the firm was in its infancy and was less selective, but once the business is established, it can afford to be a bit more prescriptive about its target clients. Success breeds success, and target clients tend to refer more target clients to your business, so the problem just gets bigger.

So how should these clients be dealt with? Is it right to just give up on them and call it a day? Maybe working with them at a loss is all that can be done? Well, think again.

We’ve got three tips that show there is another way to retain a larger number of clients without increasing recruitment costs.

Our team has decades of experience in the financial advice industry, so here are our tips for advice firms, which we’ve seen work well firsthand.

1. Boost client communication efficiency

Client communication accounts for an incredible 20% of the average adviser week.

Taking time out to converse with clients on their financial plans is integral for client success and ultimately satisfaction.

However, if you can improve the efficiency of your client communications, you can do more of it for less time and cost.

Can a meeting that requires travel be done online? Can the objectives of a video conference be met over text or email? Can you automate parts of your client onboarding process, the way in which meetings are scheduled, or how reports are created?

It’s a fine balancing act because clients really value face-to-face time, but there should be room for you to adjust. If you can increase communication efficiency when dealing with lower asset clients, you can decrease their costs, increase your time spent on more valuable work and ultimately add value to your firm.

We’ve had many changes forced upon us by the pandemic but many firms and clients are keeping the best of these changes, rather than simply reverting back to the old ways.

2. Decrease admin time

As well as boosting the efficiency of your meetings, can your back office administration process be improved?

This really is a profit drain for firms, with advisers spending 41% of their time on admin for clients.

You could be spending nearly three days in a week chasing clients for signatures, producing valuation reports and organising communication across different channels.

It doesn’t have to be this way. Embracing technology will help you to simplify your admin processes, giving you the time necessary to concentrate on profitable clients and plan for growth.

We know a thing or two about this…

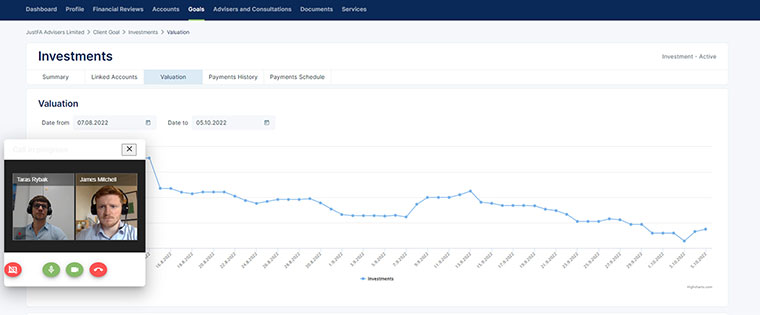

By combining a full suite of tools to cover fact finding and client onboarding with video, messaging and call functions, the JustFA platform ensures all of your admin is in one place. We provide you with an automatic framework for legal documentation that is compliance ready. Whether it’s a client service agreement or a key investment wrapper document, you’ll never have to worry about the usual paperchase again.

Better still, JustFA offers complete in-platform oversight for investment performance, meaning that you can easily identify changes required and act quicker. There are other benefits which come with our platform - you can read about them here.

With this approach, it’s more than likely that you can remove rather than add to the amount of different technology systems you use, and pay for, in future.

3. Decrease complexity and realign your relationship

For clients who still value the work you’ve done for them over the years, but who aren’t profitable enough to justify the standard service offered, a different approach might be the answer that will keep everyone happy.

Can the frequency of meetings and valuation reports be reduced or brought online? Does a minimum fee need to be introduced?

If you value a strong relationship that isn’t profitable, you need to be ready to adjust your service. In simple terms, that means the fee can go up or the service can be reduced. However, reshaping the service to something more suitable for both parties will make this a positive experience.

We’ve found that honest conversations with clients about the need for change, presented alongside a thoughtful new solution which demonstrates you do want to make the relationship work, successfully resets the relationship on new terms.

And to finish…

So, before making any rash decisions about your unprofitable client, carefully analyse your efficiency and scope room for improvement. Are you adopting the right tech and do you really need to travel to meet your client for the next meeting?

Don’t just accept high costs and low profits for your clients. Think hard about your service before you consider leaving them.