This post is intended for financial advisers only.

Content is king, even for advisers. But how can firms ensure its success? By understanding the data behind it.

Whether you're attempting to increase referrals, generate organic leads or even keep existing clients in the loop, content marketing is essential.

Tracking the performance of your content is key to ensuring an approach that can serve its desired purpose.

The ability to seek out the data that demonstrates your blog, newsletter or social media performance, and act on it correctly, could be the missing link to a return on investment.

So what metrics should you be tracking?

How, as advisers, can you interpret the data and create more effective content off the back of it?

In this blog, we’ll be answering exactly that…

Open up - newsletter metrics

If you're a financial adviser or planner in the UK, you will be used to dealing with clients of all ages. In fact, figures from Unbiased.co.uk and Standard Life show that 79% of those people who take advice are over the age of 35.

The good news is that people of all ages are highly likely to engage with email newsletters.

According to data from Statista, 23% of 35 to 44-year-olds, 26% of 45 to 54-year-olds and 31% of 55 to 64-year-olds had read marketing emails and newsletters in the previous month.

So understanding the performance numbers of this valuable communications channel is essential.

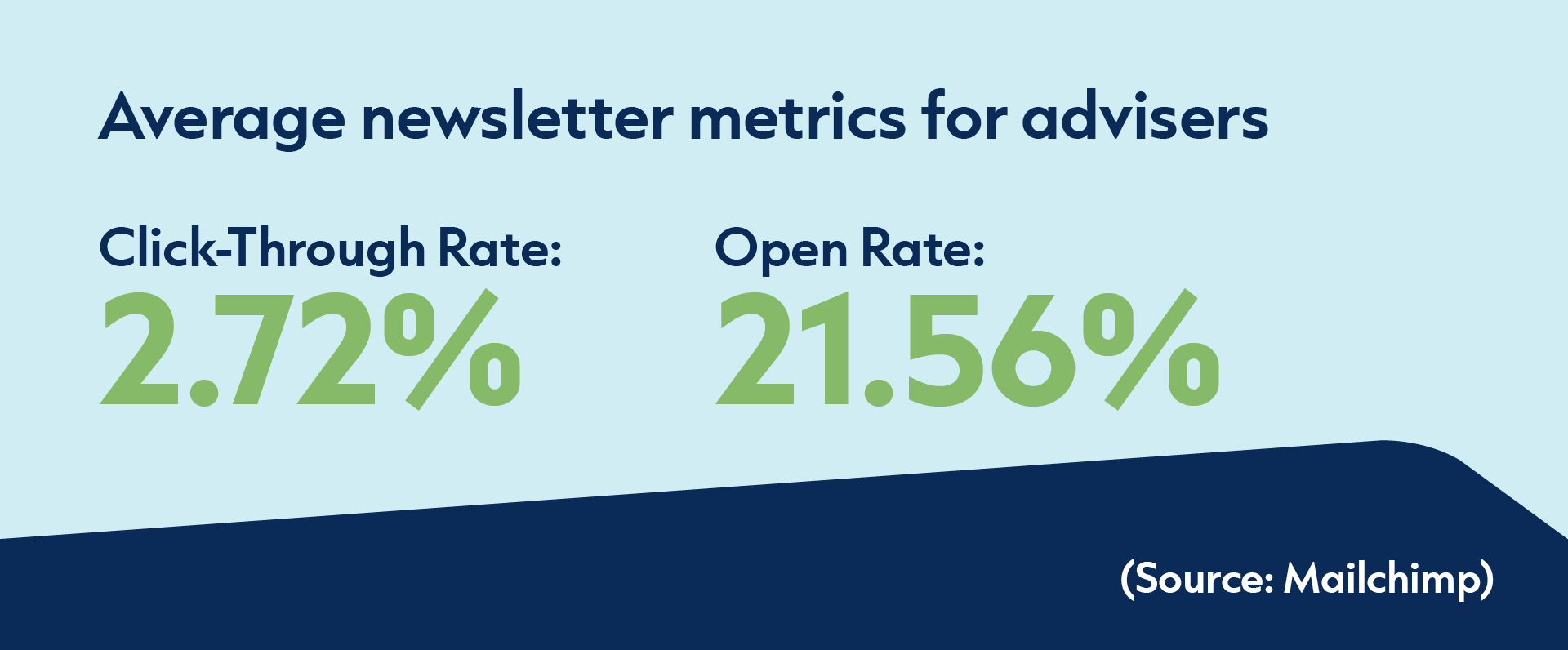

Open rate, click-through rate (CTR), and conversion rates are vital metrics you need to analyse when looking at performance.

An open rate reveals how many email subscribers are engaging with your emails by clicking on the subject line and reading further.

It’s all about the subject line and a low open rate suggests that your subject lines need to be more enticing or relatable to your subscribers.

The CTR shows the percentage of recipients who clicked on one or more links within an email, indicating the effectiveness of your call-to-action, or your reader’s interest in finding out more. It’s a really good indicator of whether your content is relevant and hitting the mark with your audience.

Finally, the conversion rate is the proportion of email recipients who completed a desired action, such as booking a meeting if they’re a prospect, after clicking on a link within an email.

Advisers whose core objective when it comes to content marketing is winning new clients and have large prospect mailing lists, will benefit most from analysing this metric. However, it’s not always easy to track conversions unless you have the right marketing technology and new enquiry processes in place. It’s all about joining up the dots and it’s not always easy to identify that the new enquiry that just landed was because they had just read your email newsletter.

Learn more about the tools advisers can use to publish and measure their newsletter data here.

It’s about time - Blog metrics

Whilst newsletters are a great way to summarise your services, company news or regulatory and financial updates, blogs offer advisers a space to go a little deeper.

Demonstrating your insight and sharing a bit of the personality and culture of your firm could make the difference when a prospect chooses you as their financial adviser over and above the business down the road.

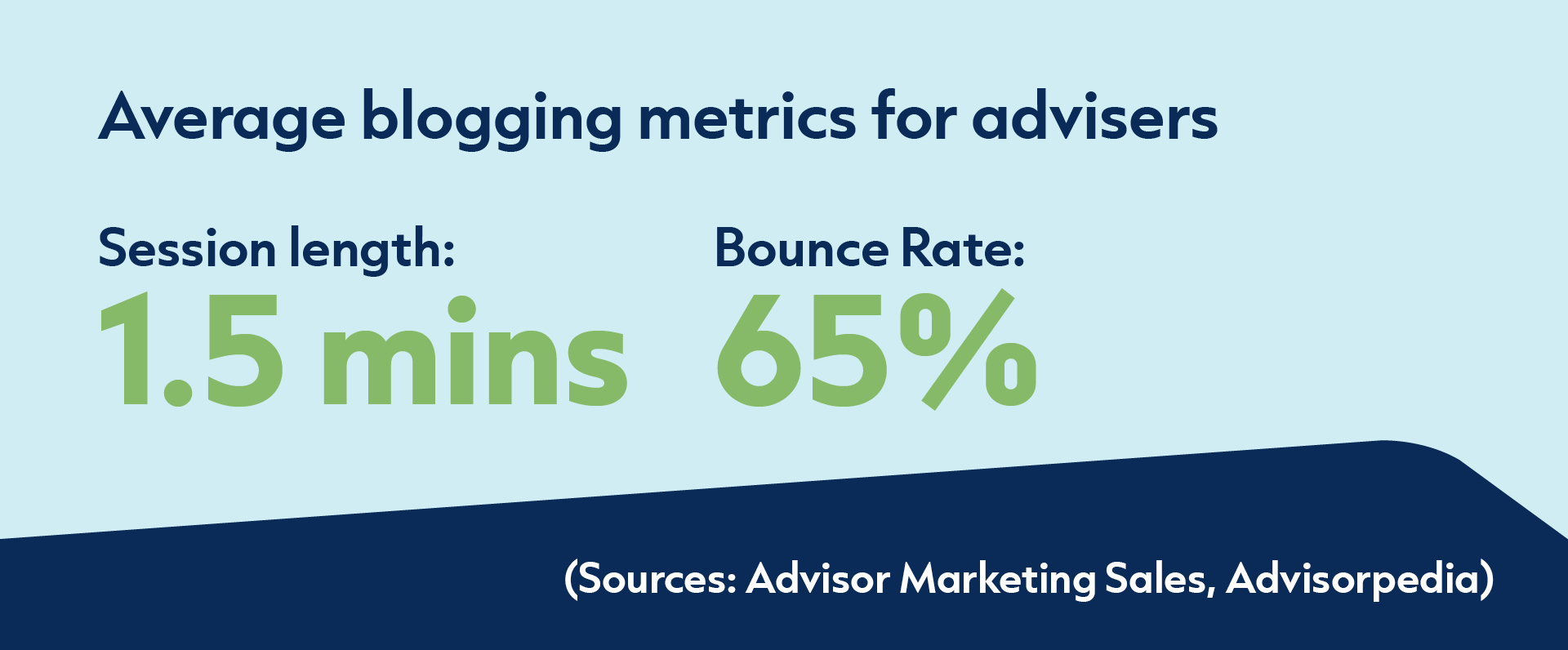

Key metrics for blog content are page views, session time, bounce rate, and conversions.

Page views and session time help quantify how many people are reading your content and their level of interest.

A high bounce rate and low session time (the percentage of visitors who leave after viewing only one page) may indicate that your content isn't engaging enough or doesn't meet visitor expectations. If this is the case, advisers should rethink the material and layout of their blogs.

Remember, you're not talking to other financial advisers, you're talking to clients and prospects who need relevant topics written in a more simplified and digestible way.

They don’t have time to look into technicalities and don’t want to read jargon-heavy text. Avoid long walls of text where possible, and add visual cues. Even simple stock images will make a positive difference.

Lastly, as we’ve already seen in our newsletter section, conversions measure how many readers are prompted to take a desired action, such as booking an initial meeting or signing up for your newsletter.

Ensure that your blog has a sufficient amount of call to actions (CTAs) throughout. Use persuasive yet clear language to increase conversions, offering a “free first consultation” button instead of a “book a meeting” button, for example.

Size matters - Social media metrics

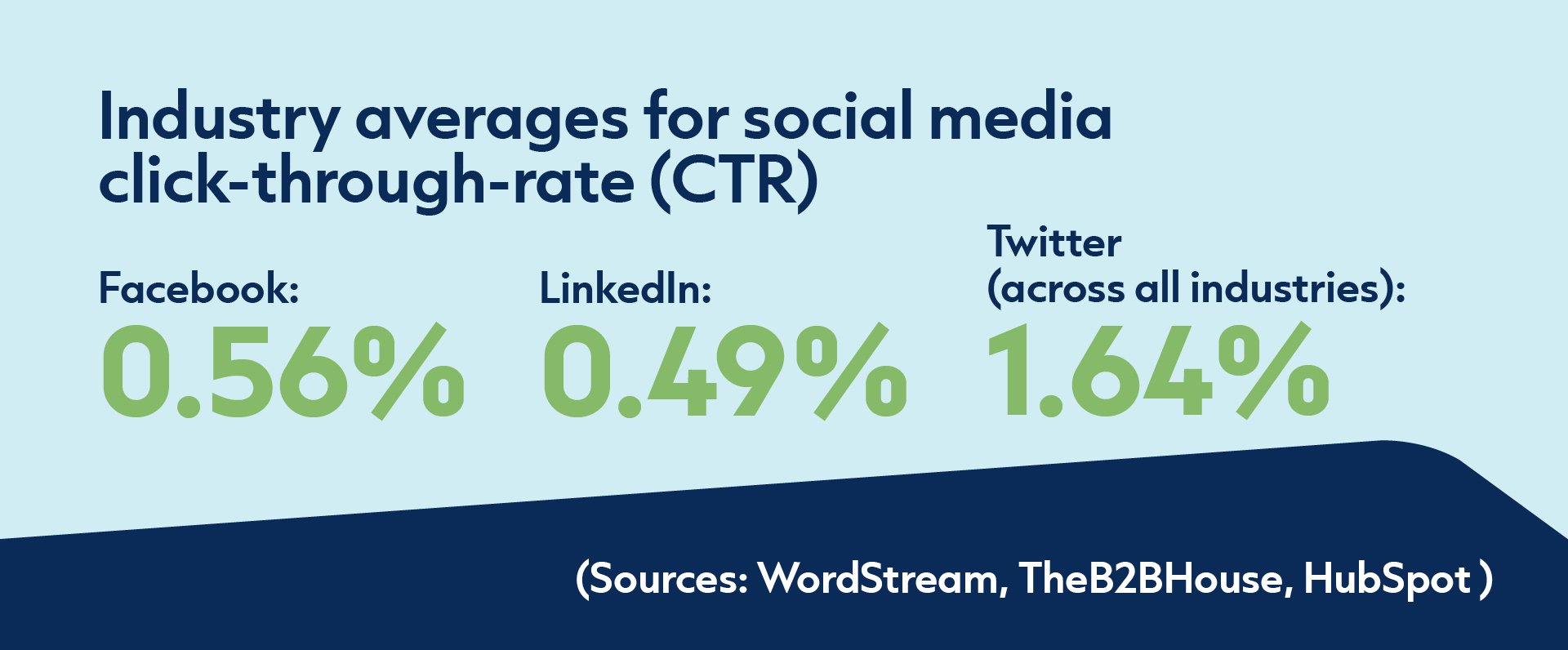

Most advisers know all of the above by now, with 94% using social media to boost their business opportunities, but just half report seeing any marketing benefits or ROI.

The key metrics to keep an eye on are follower growth, engagement and reach.

To boost follower growth, ensure that you're consistently producing high-quality, relevant and engaging content that connects with your target audience.

This could include actionable financial tips, industry insights, or thought leadership pieces. Be careful, as it shouldn't always be about financial planning, you don’t want to come across as boring. Post about the business, open up the doors and go behind the scenes to help people understand just what and who your business is really about - people buy people after all.

Another helpful tactic is to engage with others in local business groups on LinkedIn This will increase your local brand awareness and visibility, helping build relationships that can lead to referrals and new business.

Building digital relationships that can lead to new clients relies heavily on interacting with the right online community. The key is to engage regularly and consistently.

Prompt discussions by asking questions in your posts or inviting feedback. Always respond to comments on your posts to keep the conversation going and make your audience feel valued. Furthermore, varied content, such as articles, infographics, and videos, can cater to different audience preferences, potentially driving more engagement.

Lastly, to increase your reach, you can leverage LinkedIn's features like hashtags and mentions. Hashtags make your content discoverable to people following or searching for the specific topic. Mentioning others, especially influencers or companies in your posts, could extend your content to their network, thus expanding your reach.

By incorporating these strategies, you can actively work towards improving your LinkedIn metrics, creating a more influential and engaging online presence.

Be aware of who is using different social platforms

As you aim to make the most of the opportunities offered by social media, it’s worth remembering it is not one single, homogeneous tool. Social media is a catch-all term that covers many different platforms, which often attract very different audiences.

For instance, many social media platforms are far more popular with some age groups than others.

Instagram, for example, is used by 31.5% of 25 to 34-year-olds, according to Hootsuite, compared with just 8% of 45 to 54-year-olds.

Facebook, meanwhile, has seen a decline in the number of younger users in recent years. According to Statista, the number of users aged 18 to 24 fell from 24% in 2012 to 16% in 2020, while the number of users aged 65 or above rose from 4% in 2019 to 9% in 2020.

The figures are a reminder to advisers that they need to choose the right social media channel for them, depending on their business goals and where their target audience are most active.

Make the metrics work for you

Content marketing is now an essential channel for advisers looking to grow their business and win new clients.

Aside from actually doing the heavy lifting, writing the newsletter, putting together a well thought out blog, or establishing a presence on social media; understanding the core metrics will help you formulate and evolve a content strategy that can achieve your firm’s wider marketing aims.

Although we’ve shared some sector performance metrics in this article, a word of caution: there are so many variants between businesses it’s often like comparing apples and pears.

The most important performance metrics are your own. Be your own benchmark and try to improve, month on month, using all the key indicators highlighted above. If that’s your goal, you’ll be sure to succeed.