What if you could increase your advisory firm's revenue by 40% within a year while using current resources?

It's not hypothetical. Firms are achieving measurable profitability with JustFA's end-to-end platform. In an industry where incremental growth is the norm, JustFA enables transformative results by solving the fundamental efficiency challenges that most advisory businesses face.

In this case study, we'll walk you through how forward-thinking advisory firms achieve these results and how you can apply the same strategies to transform your business.

What You’ll Discover Here

-

JustFA: The All-in-One Advice & Investment Platform That Transforms Business Models

-

Case Study: How One Advisory Firm Transformed Their Business with JustFA

The Technology Dilemma Facing Today's Financial Advisers

Modern advisory firms are caught in a technology paradox: they need better systems to grow, yet implementing new solutions often creates more complexity than clarity. What advisers truly need is technology that:

- Dramatically improves efficiency with measurable impact on the bottom line

- Integrates seamlessly with existing business operations

- Frees up valuable adviser time that can be redirected toward revenue generation

"I had different conversations with people to try and figure out who else was using what tech. There are so many different providers out there," says Rachel Edwards, Director at Charterhouse Financial.

"I came across you guys on a webinar and thought, "Wow, I need that!". That will allow me to work with many younger people as I won't spend time going in and out of different systems and re-keying data. That is such a time saver. Basically, it streamlines everything for me, and I know I am compliant; therefore, the client is getting excellent service and outcomes.

Why Point Solutions Fail to Deliver Meaningful Growth

The Integration Problem

The fintech market has exploded with specialized tools promising to revolutionize specific aspects of financial advice:

- Client engagement portals

- AI-powered meeting transcription

- Automated risk profiling tools

- Digital onboarding solutions

While individually impressive, these point solutions create a fundamental problem: system fragmentation.

Traditional Approach vs. JustFA: A Direct Comparison

JustFA: The All-in-One Advice & Investment Platform That Transforms Business Models

JustFA represents a fundamentally different approach to advisory technology. Rather than addressing isolated pain points, it reimagines the entire advice journey as an integrated digital experience.

The 3X Advantage

JustFA's end-to-end design speeds up the entire advice process three times faster than traditional methods. It's not a marginal improvement—it's a complete paradigm shift that creates measurable adviser capacity that translates directly to business growth.

From Efficiency to Profitability: The JustFA Growth Formula

We recommend starting with multi-client migration to take advantage of the JustFA end-to-end system. We have seen the tremendous positive impact it can immediately have on advisory business and its profitability.

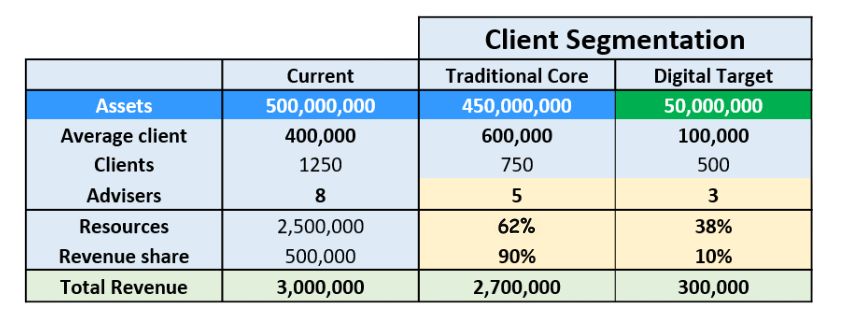

We recently completed a case study with £500m AUA IFA firm, and here's what we did.

Step 1: Strategic Client Segmentation

Identify 10-20% of your client base (typically smaller portfolios) that would benefit from a digitally enhanced service model.

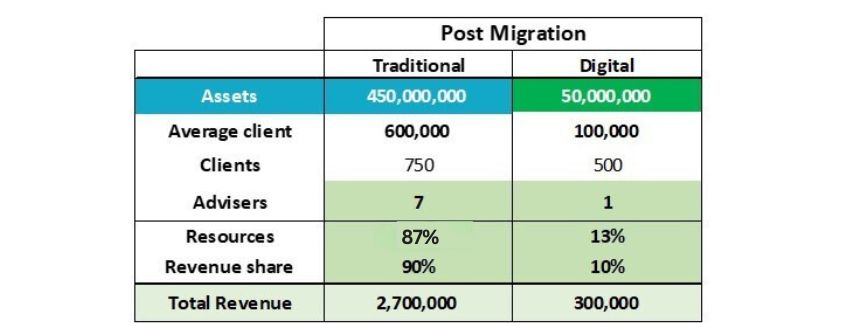

Step 2: Digital Migration

Transition these clients to JustFA's platform. The streamlined process delivers a high-quality advisory experience with significantly less adviser time.

Step 3: Resource Reallocation

The efficiency gains free up adviser capacity—often reducing the time needed to service these clients by 60-70%.

Step 4: Accelerated Acquisition

Direct newly available adviser resources toward acquiring ideal-fit clients for your traditional service model.

The financial impact is substantial and predictable: firms implementing this strategy can generate 10-20% in new assets beyond their typical growth targets in the first year and deliver revenue increases between 40% and 80% within the first year following migration.

Seamless Implementation: How JustFA Minimizes Disruption

Many advisers hesitate to adopt new technology due to implementation complexity and concerns about business disruption. JustFA addresses these concerns with a structured onboarding process:

The 2-month JustFA Transition

- Days 1-15: Due diligence and system configuration

- Days 16-30: Staff training and pilot testing

- Days 31-45: Preparing client data for migration

- Days 46-60: Client Migration and complete rollout

What do advisers like most about working with JustFA? We do most of the heavy lifting, from system set-up to fully automated client migration.

"We did our research and looked at the criteria, and JustFA fit the bill for us. It allowed us to reduce manual client interactions and automate processes," said Ray Pettitt, Managing Director at Galleon Wealth. "Being able to migrate clients digitally, instead of meeting each individually, saved 80% of the time. It was a no-brainer."

Case Study: How One Advisory Firm Transformed Their Business with JustFA

Firm Profile Before JustFA:

- £500 million in assets under advice

- 1,250 clients in total

- £400,000 average assets per client

- 8 advisers total

The Challenge:

They discovered that a small segment of its client base (in terms of attributable AUM) was consuming a disproportionate amount of resources:

- 500 clients with an average of £100,000 in assets (10% of the assets)

- Required 3 out of 8 advisers to service properly

- Consumed nearly 40% of the firm's total resources

This imbalance was limiting growth potential and putting pressure on margins.

The JustFA Solution:

This IFA business implemented a strategic transformation:

- Migrated these 500 smaller clients to a digital service model powered by JustFA

- The efficiency gains allowed them to free 2 of the 3 advisers who had been servicing these clients

- The resources/revenue balance is restored

The First-Year Target:

- The 2 freed advisers can bring at least 80 new clients into the core traditional proposition

- These new clients have an average portfolio of £600,000

- This can add £48 million in new assets under advice and £1 million in additional revenues

Revenue increase projections are nearly 40% in the next year.

The firm is providing better service to all client segments and is on target to dramatically improve its growth trajectory during the first year after the migration.

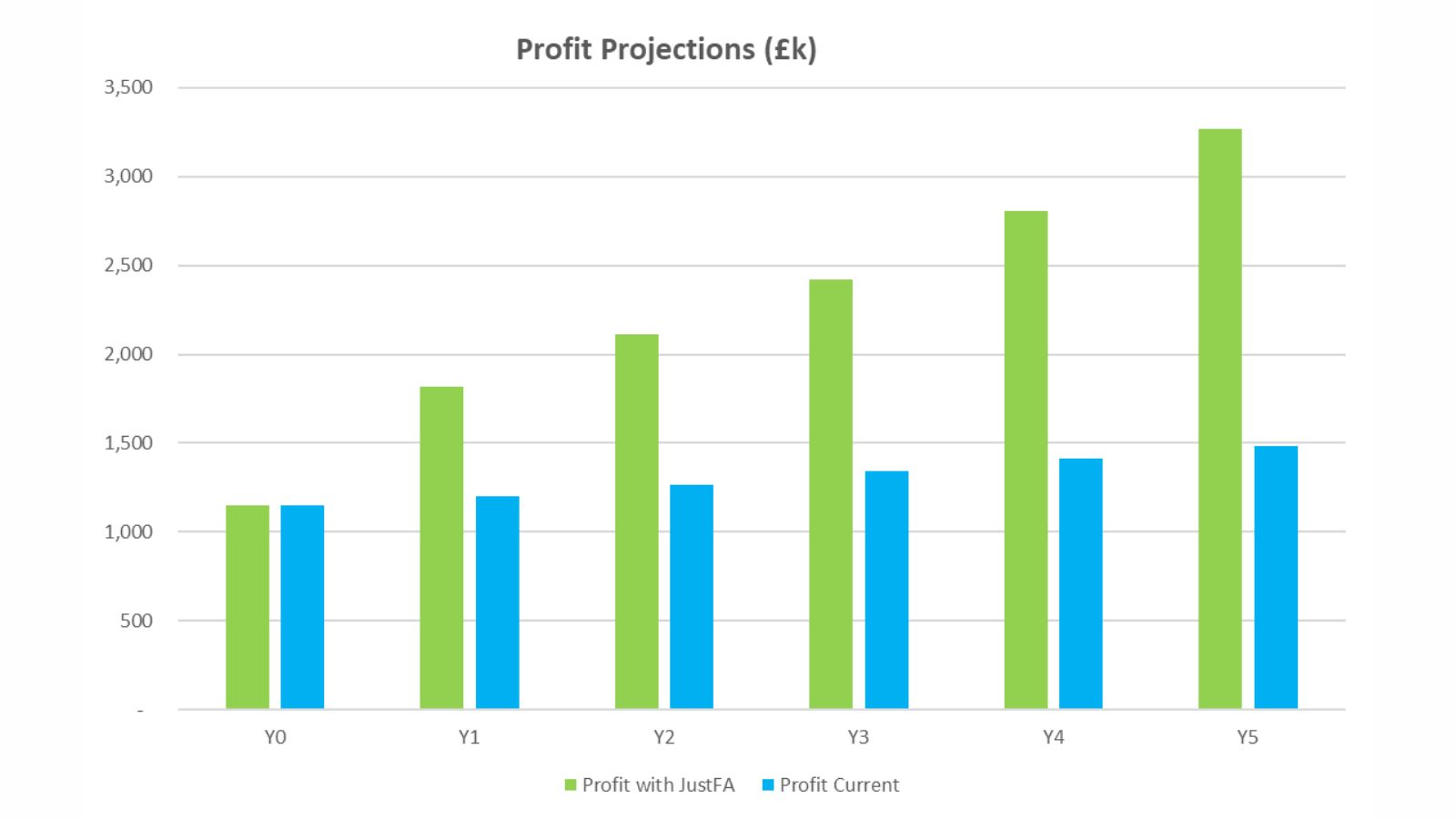

Building a Dual-Growth Engine: The Long-Term Advantage

While the immediate impact of JustFA is impressive, the long-term strategic advantages are even more compelling. By establishing a digital service segment, advisory firms create a second growth engine that compounds over time.

Five-Year Growth Projection for Dual-Service Model

Traditional Segment Growth:

- Continues to serve higher-value clients with a high-touch approach

- Benefits from increased adviser capacity and focus

- Typical annual growth: 10-15% after JustFA implementation

Digital Segment Growth:

- Serves tech-savvy clients with a scalable digital-first approach

- Lower service costs create attractive margins

- Typical annual growth: 25-30%

By Year 5, firms will see their profit increase by 2.5 times. The digital segment will become a substantial business in its own right, growing to represent 20-25% of total assets.

Enhanced Client Acquisition

The digital experience itself becomes a powerful acquisition tool. JustFA clients:

- Are 35% more likely to make referrals compared to traditional service models

- Generate 2.7x more online engagement when sharing content

- Provide digital pathways for integrating with next-generation clients

Cross referrals between Traditional and Digital segments benefit both sides of the business.

Ready to Transform Your Advisory Business? Let's Talk!

We all know the world of advice is changing fast. The question isn't whether you need better technology—it's whether you're ready to move now that could genuinely transform your business.

If you're like most advisers we talk to, you're probably:

- Spending way too much time on admin instead of advising

- Watching smaller clients eat up disproportionate resources

- Wondering how to scale without sacrificing quality

- Feeling that growth is harder than it should be

Sound familiar? That's precisely why we built JustFA.

Our advisers repeat the same refrain: "I wish we'd done this sooner." They can't believe they waited so long once they saw how a truly integrated platform changes the game, freeing up advisers, creating capacity, and driving growth.

Let's Get Specific About Your Business

Every firm is unique. Your client mix, service model, and growth goals are unique to you. That's why we don't do generic demos.

Instead, let's have an honest conversation about your business. In just 30 minutes, we can:

- Look at your current client segmentation

- Identify where you're losing time and money

- Show you specifically how JustFA could create capacity

- Calculate your potential first-year revenue impact

No pressure, no sales pitch—just a straightforward look at what's possible for your specific situation.

Book Your Discovery Call Today

Don't keep wondering what's possible. Let's talk about your business and how JustFA might fit.

Reach out to Debbie Dry, Head of Business Development and book a Discovery Call.

Mention this case study, and we'll prepare your business transformation model to show you what is possible before we speak.

What could your business look like with 30%, 40% or even 50% more revenue within the next 12 months? Let's find out together.