Advisers spend around 15 hours on admin every week. This can induce burnout and stops firms from spending time on what matters most… So, what’s the answer?

As a financial adviser, you know exactly where your time needs to be spent to improve referrals, boost client satisfaction and ultimately increase the value of your firm.

Unfortunately though, chasing these goals probably isn’t where most of your time is spent.

Advisers dedicate up to 41% of their working hours to administrative and office management tasks

Aside from the time consuming nature of this work, the impact it has on firms can be damaging.

Whilst not a perfect case study, high levels of admin are driving stress levels up for Australian financial advisers.

Around 42% report that they are tempted to leave the industry due to admin induced burnout.

The same study* found that respondents with high levels of job satisfaction spent less time on compliance and administration and more time adding value to their firm.

High amounts of time spent on admin isn’t the necessary evil many think that it is.

Through the use of fact finding and risk profiling, a compliance ready, paperless framework and client engagement tools that will shatter meeting time and preparation, our platform delivers a service for advisers that can slice admin time.

What do these features look like exactly?

How do they work and what are the precise impacts on time management for advisers?

In this blog we’ll answer exactly that.

*AIA Australia’s Australian Financial Advisers Wellbeing Report

Fact finding and risk profiling

The risk profiling and fact finding element of onboarding or servicing a new client is always a time consuming activity.

Advisers spend hours creating risk questionnaires, chasing clients for personal information and waiting on the postal service for their return.

Even for firms that embrace digital to overcome these issues, many online fact finding and risk profiling tools are disjointed…

Surely vital client information needs to be in the exact same place where you service clients?

This is an idea that has driven the creation of our fact finding and risk profiling tools.

By bringing these both into one singular platform, we help advisers save time and increase efficiency.

Our risk profiling tool lets you ask the important questions without having to make a trip to the post-office, or worry about your client's letters getting lost in the mail.

As well as reducing time spent on admin, the fact finding and risk profiling tools give you safer and quicker access to the documentation that matters, meaning you can have better oversight on your clients goals.

These features have been designed with user experience and flexibility in mind, allowing advisers to easily customise the fact-finding process to meet their clients specific needs or circumstances.

The result?

A better, more personalised approach to your clients, who will be more likely to refer your business after receiving such a valuable service.

Compliance ready paperless framework

Compliance is a crucial aspect of the financial advice industry, and advisers must adhere to a range of regulations and standards.

One significant challenge that advisers face is ensuring that all documentation is compliant and up to date.

We provide a solution to this, offering advisers a compliance-ready framework.

Not only does our framework keep advisers on the right side of compliance, but it keeps documentation paperless too.

We’ve already talked about the benefits of this, but we’ll remind you.

A paperless documentation system keeps your firm safe from the long wait for customers to send their important information via mail.

Time and time again we’ve come across advisers who struggle with this problem.

Documentation takes weeks to get over the line because royal mail have lost paperwork or because your files have sat at the bottom of a big pile of a client's junk throwaway post.

Keeping documentation paperless gives you complete oversight of your client, allowing you to keep easy tabs on all of their investment history, their past statements or their personal and financial goals.

Like our fact finding and risk profiling tools, we’ve integrated the framework into our system so that the place you meet with clients is the same place you can remind yourselves of their situation, goals or pain points.

21st century engagement tools

We live in a digital age where everyone wants everything all at once, and this includes financial advice.

Whilst some clients have welcomed a return to face-to-face meetings, others will be desperate to keep remote advice a part of their life, because of its time saving nature.

This saved time can translate to the adviser too, ensuring your business gets the most out of the remote work revolution.

With our Client Portal, not only can you reduce your workload by eliminating paperwork and unnecessary processes, but your clients can communicate with you in the same place where they can sign their personal information, and see their own investment wrappers.

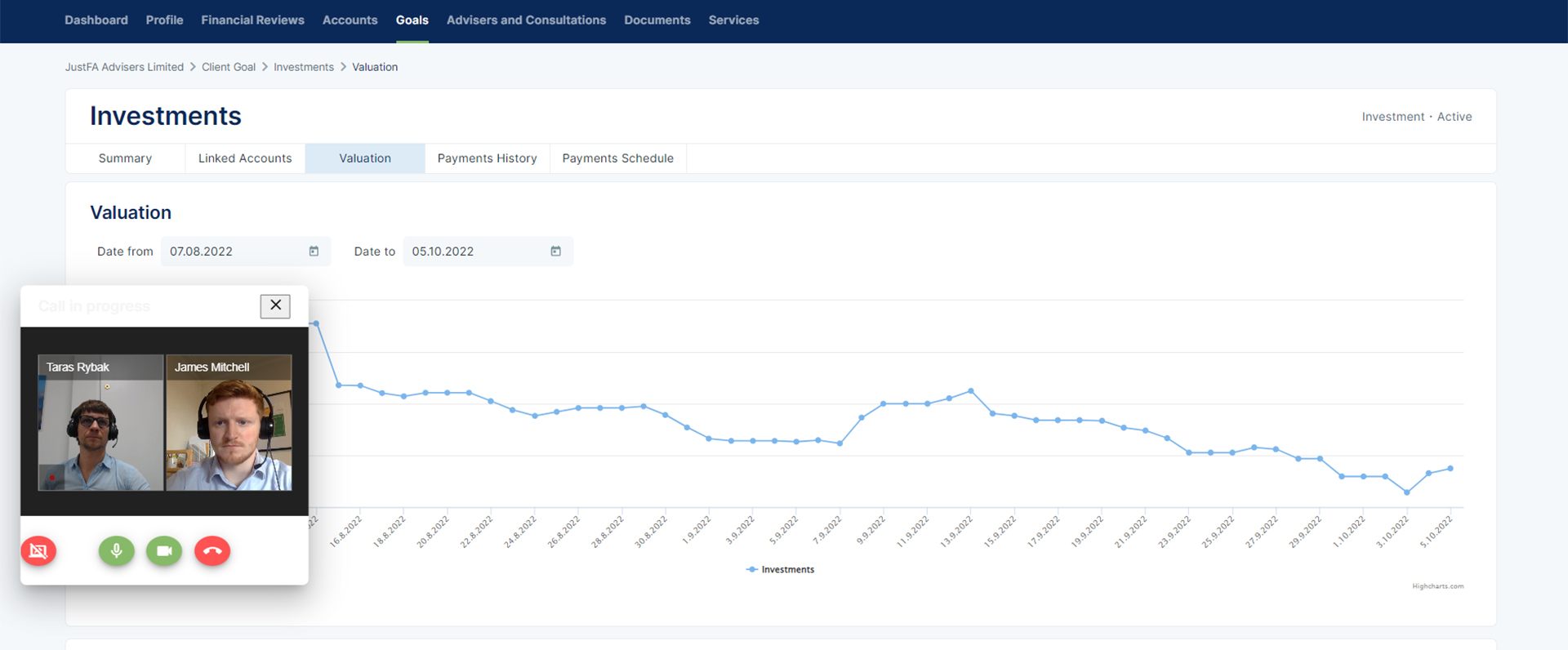

Our Client Portal leverages advanced video, chat, co-browsing and screen-sharing to help clients connect with their advisers.

If you need to have a call with a client, you can easily check their active status and contact them.

There's no need to worry about compliance issues, as our system automatically records call notes and saves them to the client file, freeing up your time for more valuable tasks.

Our streamlined communication tools are a testament to how our platform makes it easy for advisers to provide exceptional value to their clients…

Say goodbye to confusing a client with a disjointed client engagement tool separate from your client portal or website.

As well as providing industry leading video and audio communication tools, we also provide instant access to conversations with the chat function, ensuring that your clients can connect with their advisers, any time of the day. Eliminate the scramble for more nuanced client details if you forget to file them properly too, every piece of communication automatically saves within our system.

JustFA

JustFA

Cutting admin time dramatically increases the amount of hours in a week that can be spent on growing your firm, adding value to your service or getting quality referrals from clients.

Through fact finding, risk profiling, a compliance ready framework and a suite of client engagement tools fit for 2023 and beyond, JustFA helps you achieve the outcome desired by so many advisers.

Book a demo today and increase efficiency, save time and boost the client experience with JustFA…